MSI came to live in the late 80’s thanks to American Express and an alliance with big department stores. The concept is simple:

- A seller offers their products for customers to buy in installments as part of a special sales offer

- A customer buys an item and receives a charge on their credit card for the full amount

- Each month the issuing bank will deduct from their debit accounts the amount for each installment, which typically varies between 3 and 12 months

The popularity of Meses Sin Interesses (MSI) is due to two factors. For sellers, it’s a way to increase the number of sales and the average ticket. For the consumer, it’s a way to finance large purchases with certainty because they know in advance how much will be paid monthly per installment without the hassle of having to calculate the interest rate in every statement.

You are probably asking at this point, “If the shopper does not pay for interest, who does”? When a store offers Meses Sin Interesses, they are betting that they will sell more, and therefore, it justifies to absorb the financial costs of offering installments.

It’s also important to mention that sometimes the establishment will raise the price of a product in order to offer MSI to its costumers, or they can offer different pricing depending on whether you pay for an item in one installment of multiple installments.

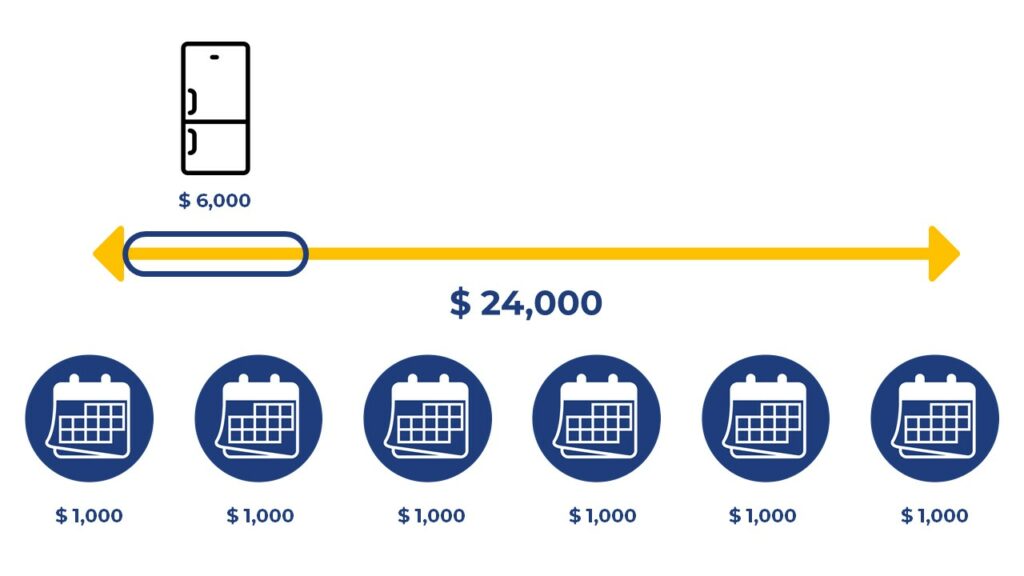

To understand some of the critical concepts of MSI, I’ll use the following example. Let’s suppose that Taconildo has a credit card limit of 30,000 pesos, and he bought a 6,000 pesos refrigerator in six installments.

After the purchase, the bank will consider 6,000 pesos as the total amount used from his balance. However, it will only charge 1,000 pesos per month on his statement, and the available limit for purchases will be 24,000 pesos.

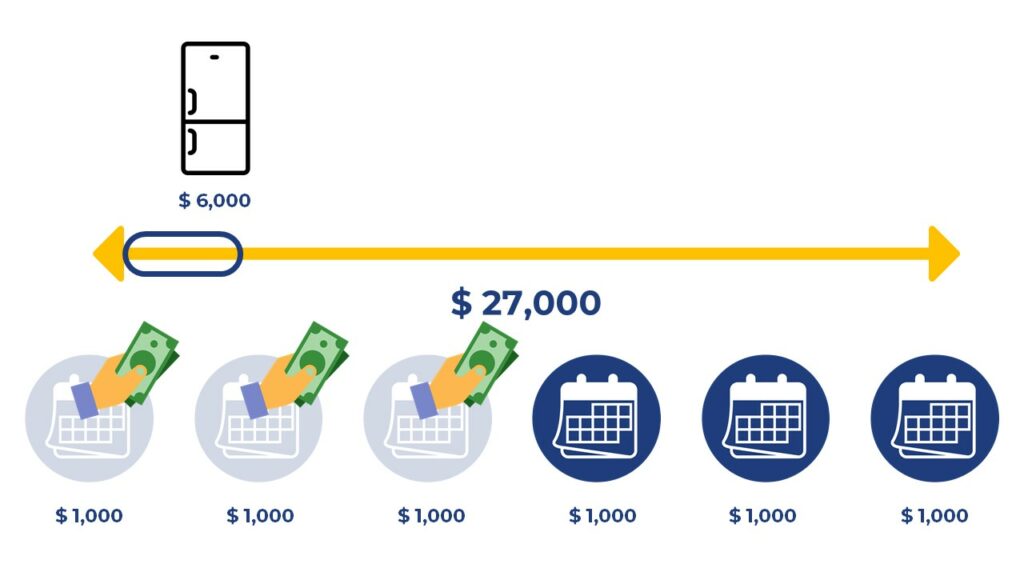

Taconildo will have to pay 1,000 pesos per month, and after each payment, his available balance increases by 1,000 pesos. This means that after three months, his available balance for purchases will be 27,000 pesos.

For purchases above the credit card limit, the buyer can combine multiple payment sources. For instance, if Taconildo wanted to purchase a 35,000 pesos 8k TV, he could pay 5,000 pesos in cash and 30,000 in installments.

In 2019 24% of credit card issued were used to purchase using MSI. If you are selling products with a high aggregated value, you should consider MSI for your business.