Although PIX has been in the spotlight for the past few months, there are quite a few misconceptions about it. For some, it is not clear what it does, who can use it, where it works, how much it costs, what type of services you can buy with it, and if it will supersede other payment methods. In this article, I will clarify these doubts.

PIX became popular among domestic merchants and e-commerce platforms in Brazil because of its settlement time and cost. Unlike credit cards, which take merchants up to 31 days to receive funds, sellers receive earnings from PIX transactions in real-time. Although real-time transactions are a big plus, PIX’s low cost—just a few cents compared to the up to 6% fee that acquirers charge—has been the driving force behind its widespread adoption.

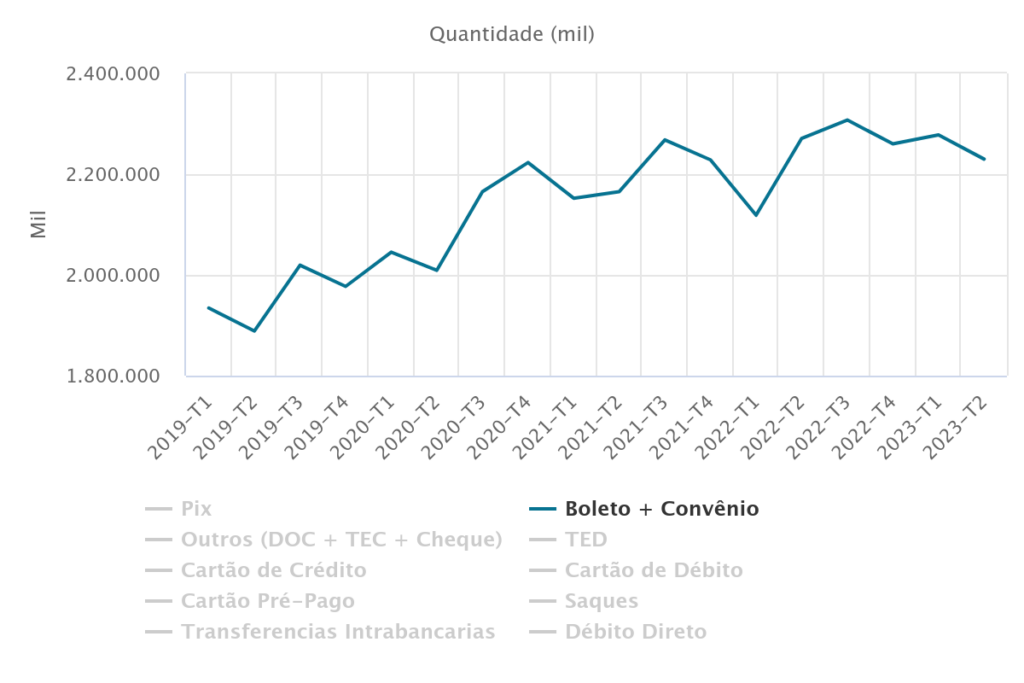

In 2020, when PIX was launched, I wrote an article predicting that PIX had the potential to replace Boletos. It was a premature guess! There isn’t a concrete projection for BACEN to phase it out, and boleto transactions have remained relatively stable in the past three years. Although PIX indeed addressed e-tailers’ inventory issues, Boleto still caters mainly to the unbanked, who are not online and therefore cannot use digital payment methods.

Now, with more data to analyze, I risk saying that Boleto will eventually die down due to generational changes and the increase in internet access. As Gen Z takes over, boleto usage tends to decline. Boleto competes with credit cards because of its cost to merchants, and with boletos because it’s more practical for the end user.

If you are unfamiliar with the technology, PIX was created to reduce the time and costs associated with banking transfers. It is based on the digital transfer of resources and is integrated into traditional banking rails, creating an instant payment flow.

When sending resources, you must have the destination account key. Understanding how the PIX key works is simple. Every bank account has a code, right? Generally, a combination of branch and account number. With PIX, it became simpler, as the key serves as an identification in the banking system, ensuring that the money follows the correct path.

The PIX key is what identifies the route to your bank account. Users can choose from four options when creating PIX keys to address their accounts:

- CPF/CNPJ

- Cellular number

- A random key (in case the recipient does not want to share any personal data, they can create a random key).

Any brick-and-mortar or online establishment with a bank account, regardless of the type of business, can have a PIX key, online or on a POS. You could use PIX to buy bitcoin if you want.

While PIX is a Brazilian technology, it is on BACEN’s roadmap to internationalize it. It would potentially compete with SWIFT, reducing bureaucracy and making transactions faster. It makes sense because it would make transactions more efficient, cheaper, and transparent.

If you would like to receive more information on PIX, feel free to send me an inbox message.